Corporate Finance and Equity Funding

Financing Decisions

Advantages of Equity Financing

The major benefit of equity financing is that shareholders of the firm are not entitled to any certain return (they may not even get dividend) so the risk of investment is with shareholders. Another advantage of the cost of equity is that it does not increase the financial distress of company.

Disadvantages of Equity Financing

As shareholders bear the risk there an expectation of return on their investment is high due to which cost of equity higher.

Debt Financing

Sometimes firms rather than issuing equity may decide to take debt from external sources, such external financing is called debt financing. Debt financing can be done by two methods one is by taking a direct loan from bank and other is by issuing debentures or bonds in the name of a company.

If a firm chooses to obtain financing through debt, it must ensure fixed payments to its investors. For example, if a firm chooses to issue a bond then it is bound to pay coupons to the investors and if it takes a loan they must pay interest on that loan.

Advantages of Debt Financing

The main benefit of obtaining funds through debt is that cost of raising debt is generally lower than the cost of equity. This is because since the risk of investment is not borne by debt investors, thus their return expectation is lower than the expectation of equity investors.

The second advantage is that if there is debt on the company’s balance sheet, then the management firm will work to remove inefficiencies from the operations of the company to full fill the debt obligation. This implies they will reduce the corporate spending and hence principal-agent problem for the company will be minimized.

Disadvantages of Debt Financing

Main drawbacks of debt financing are the first firm is liable to pay the fixed return to its debtors. Financial distress (risk of a company becoming insolvent) increases with the cost of debt. Hence the cost of raising debt is directly proportional to the amount of debt in the entire capital structure.

Advice to raise Business Capital

Advice which financial advisor gives to a company is that company should raise funds in such a way that weighted Average cost of capital is minimized. It may seem that since the cost of debt is less than the cost of equity so it is better to raise all the capital through debt. But as the amount of debt increases both costs of debt and equity increases it is so because the amount of debt increases financial distress of company. Hence it is important for a company to maintain a proper balance between debt and equity so that over cost of capital which is a weighted average of cost of debt and cost of equity is minimized.

Dividend Decisions

What is Dividend Decisions?

Dividend policies have a significant effect on retaining cash balances for example for maintaining constant dividend policies companies might maintain certain cash reserves so that company can maintain the same level of dividend in a year in which profit is low.

Some firms after investing in all projects which will create positive Net present Value choose to accumulate cash balances because retaining cash balances helps companies to increase its cash reserves which can be used in sudden need of investment without going to external sources for capital. Cash balances on the balance sheet also help firms in getting capital at lower cost. Finally, excess cash helps companies to help with growth opportunities and avoid bankruptcy cost.

There is a certain disadvantage of holding excess cash. First is that holding cash has an opportunity cost associated with it, cash could be used to create financial assets. Second is that cash is generally considered as a negative leverage and there are tax disadvantages associated with holding cash. The third is a disadvantage of holding excess cash is the agency cost associated with agency conflict If there is excess cash available management will increase its corporate spending which may decrease cost efficiencies of the company.

Types of Dividend Policies

Constant dividend policy: In constant dividend decides to pay a common fixed dividend, advantages is that firm provides fixed cash flow to its investors whereas disadvantage is that it is not a flexible approach as a firm may suffer through the cycles of boom and recession.

Constant growth: The constant dividend growth formula P0 = D1/(ke - g) assumes (1) the dividends are growing at a constant rate g forever, and (2) ke< g

Firm gives dividend with fixed growth which allows investors to generate incremental cash flows

Residual dividend policy: The Residual model of Dividend: the Residual model of dividend conditions that, the firm will pay the dividends to its stockholders simply after all the requirements of capital expenditure in near term has been satisfied, thus by residual dividend theory firm uses leftover funds to pay a dividend to its shareholders.

Main argument in favor of residual dividend is that as the incomes are first utilized for profitable future projects and this tends to enhance efficiency of resources used for corporates because if managers fail to pay cash as dividend after all profitable investments, they tend to make use of cash in manner which will destroy the value of the firm. Residual dividends also help in keeping appropriate cash reserves to preserve liquidity in the firm.

Arguments in contradiction of residual dividend policy are, the first manager tends to follow steady dividend policy, which is more favored by shareholders so managers incline to smoothen dividend payments over a period of time. Management may retain certain excess cash in certain periods and may borrow short-term loans in order to fulfill cash necessities so that they can follow consistent dividend policy.

As far as personal view is considered I trust that firms initial in Introduction and growth phase follow residual dividend policy that is dividends will only be distributed after fulfilling capital expenditure requirements but in maturity phase firms tend to stabilize their dividends over a period of time.

Investment Decisions?

First is investment decisions, investment decision help firms to make the best use of their money and generate value in future. Investment decision is evaluated using the process of capital budgeting.

Cash Flows: The total amount of money being transferred into and out of a business, especially as affecting liquidity.

Relevant Cash flows: A sunk cost is a cost that has already occurred, so it cannot be part of the incremental cash flows of a capital budgeting analysis

Opportunity cost: An opportunity cost is what would be earned on the next-best use of the assets. An incremental cash flow is a difference in a company's cash flows with and without the project

Discount rate: A discount rate is a rate which is used to adjust money receive in future in terms of its value as of now.

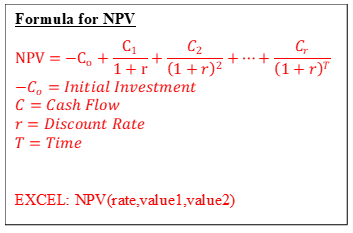

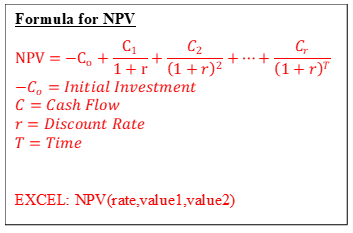

Net Present Value: Net present value is one of the major techniques evaluate an investment. NPV is the net present value of projects, it signifies net value created by the project because of future cash flows.

NPV gives the amount of value created by any project in the firm, for calculating Net Present value all the cash flows in the future are discounted at a discount rate and then the net values of discounted cash flows after subtracting the value of the initial investment is the NPV amount or the value created by the firm.

If the value created by the firm is negative this signifies that instead project destroys the value of the firm rather than creating it.

Here value signifies cash flows and the rate is discount rate. Discount rate used is cost of capital associated with particular project

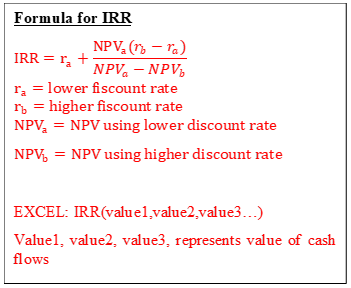

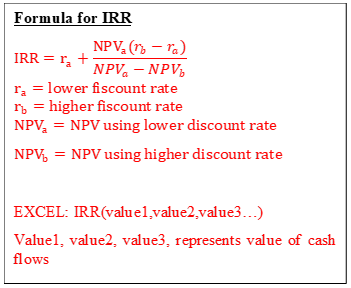

Internal Rate of return: Internal Rate of return is the rate of return at which the NPV of the project is zero, this implies it will use IRR as the discount rate we will get NPV as zero, thus IRR signifies the effective annual returns earned by the firm on the project an annual basis for the period of years.

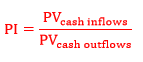

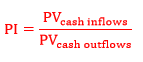

Profitability index: Profitability index signifies the whether the project is profitable for the firm, if the profitability index is greater than 1 than the project is profitable

Payback period: The length of time required for an investment to recover its initial outlay in terms of profits or savings.

Independent and Mutually Exclusive Project

Independent: If both projects are independent then we should accept both the projects since both of them have positive NPV, IRR and MIRR greater than the cost of capital and profitability index greater than 1.

Mutually Exclusive: If both projects are mutually exclusive then we should accept project X because it has higher positive NPV, IRR, and MIRR greater than the cost of capital and profitability index greater than project y.

Login | Sign Up

Login | Sign Up